- The Level Up

- Posts

- Why the Minimum Wage Freeze Is Your Problem Too—and How to Solve It

Why the Minimum Wage Freeze Is Your Problem Too—and How to Solve It

Why the Economy Feels Rigged—and What to Do About It

The economy doesn’t just feel rigged; the numbers prove it. Since 2009, while CEOs have stacked profits, the federal minimum wage has fossilized at $7.25 an hour. Meanwhile, everyday costs—like a Big Mac or rent—have climbed relentlessly. This isn’t a glitch; it’s a design flaw we can fix. The current administration talks about bringing jobs back to America through tariffs to re-invigorate the lower middle class. That might work, but will take years to implement and will potentially create huge economic waves en route to their desired outcome (if they get there at all!). Today we explore a simpler move: just raise the minimum wage!

The Cracks Show

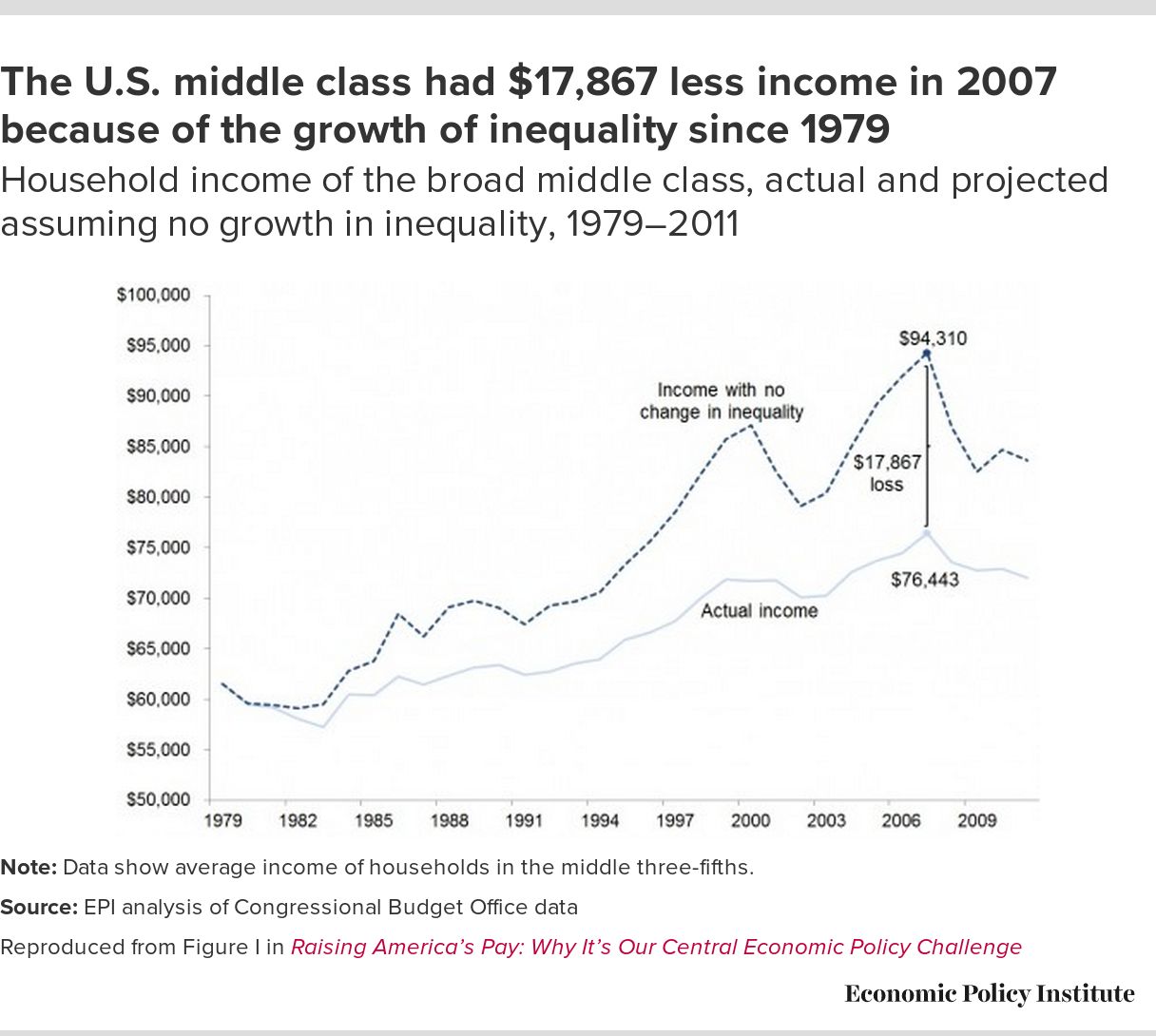

Imagine a game where the winners keep rewriting the rules. Treasury nominee Scott Bessent recently called the expiration of $4 trillion in tax cuts an “economic calamity”—a plea to shield the elite’s gains. But the real calamity is already here: 18 million households can’t afford enough food, and 12 million burn over half their income on rent and utilities. The system isn’t broken for everyone—just for those at the bottom.

Why It Hits Home:

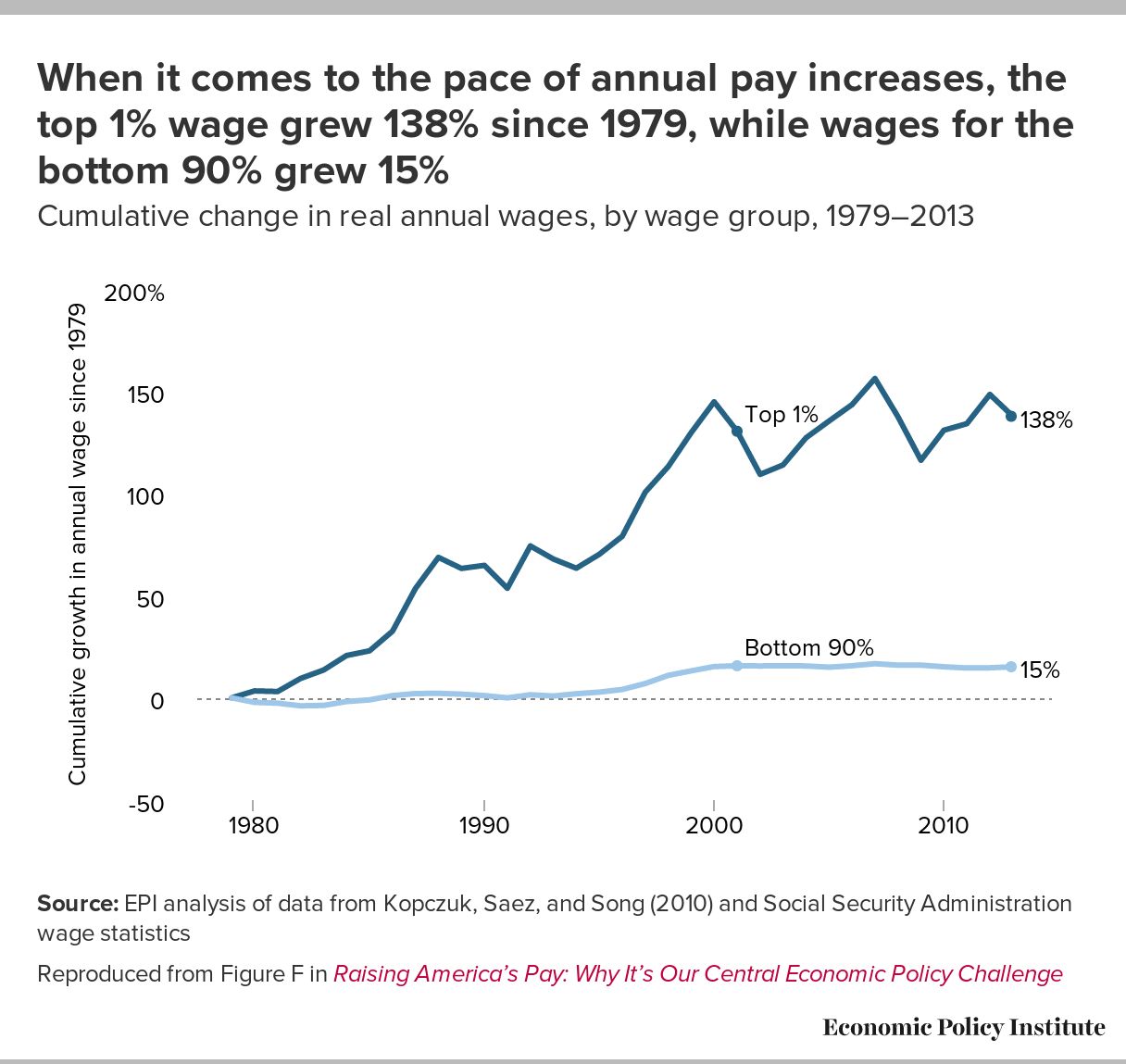

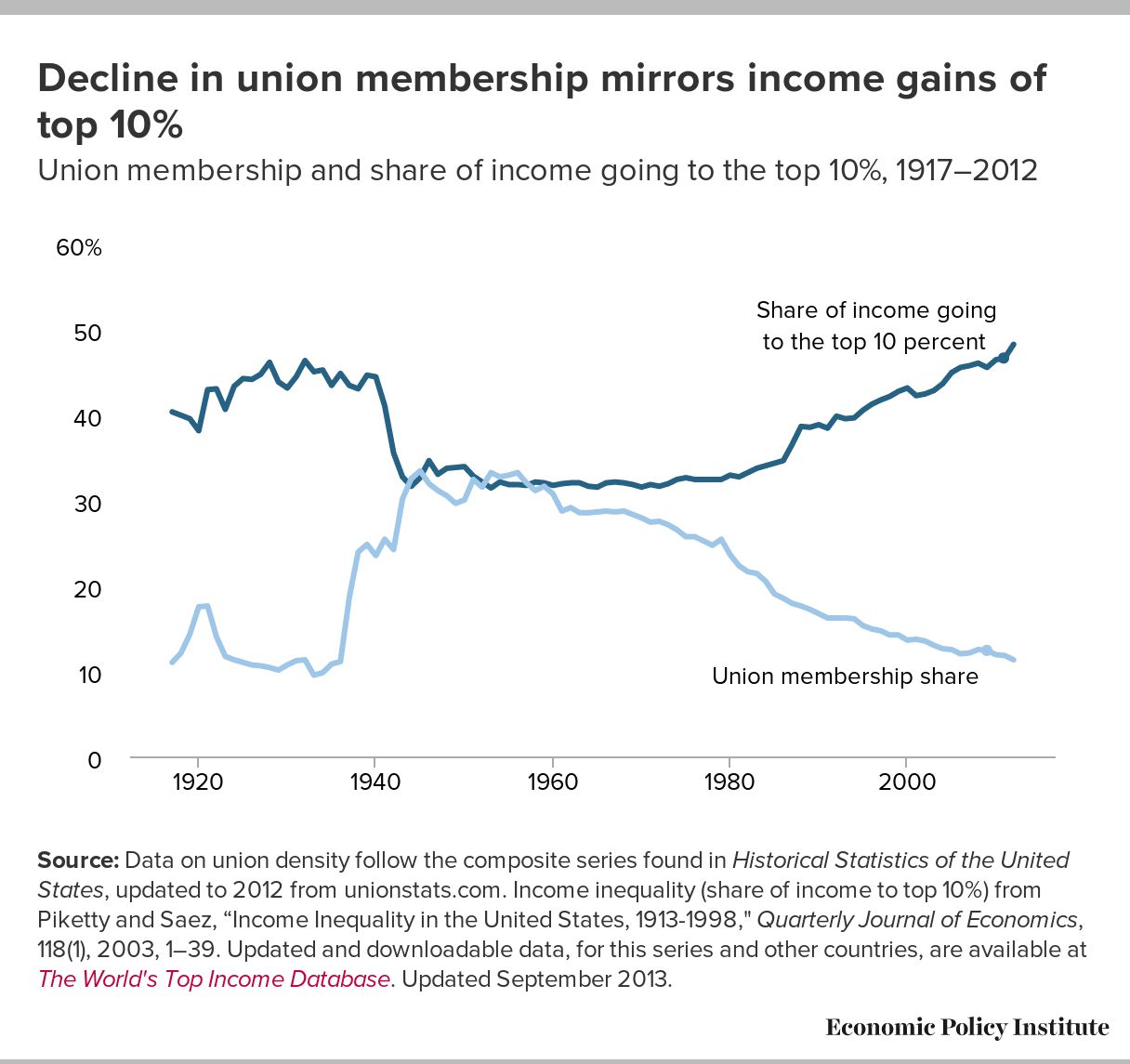

Wage stagnation isn’t abstract. It’s why health deteriorates, families fracture, and trust in institutions erodes. John Rawls’ veil of ignorance asks: if you didn’t know your place in society, would you design this? The top 1%’s income share has nearly doubled since 1979, while the rest scramble. That’s not a market; it’s a funnel.

The Numbers Don’t Lie

Since 2009, costs have surged while wages haven’t budged. A Big Mac, $3.54 back then, now runs $5.99—a 69% jump. Rent’s worse: from $1,010 monthly in 2009 to $1,607 in 2025, up 73%. The Nasdaq? Up 800%. Minimum wage? Still $7.25.

What’s Clear:

A Living Wage Makes Sense: MIT’s Living Wage Calculator shows $27.81/hour in LA, $22.75 in Kansas City for a single adult’s basics. Yet 1 in 4 workers earns under $17. A $25 minimum could cut obesity, depression, even crime—by giving people room to breathe.

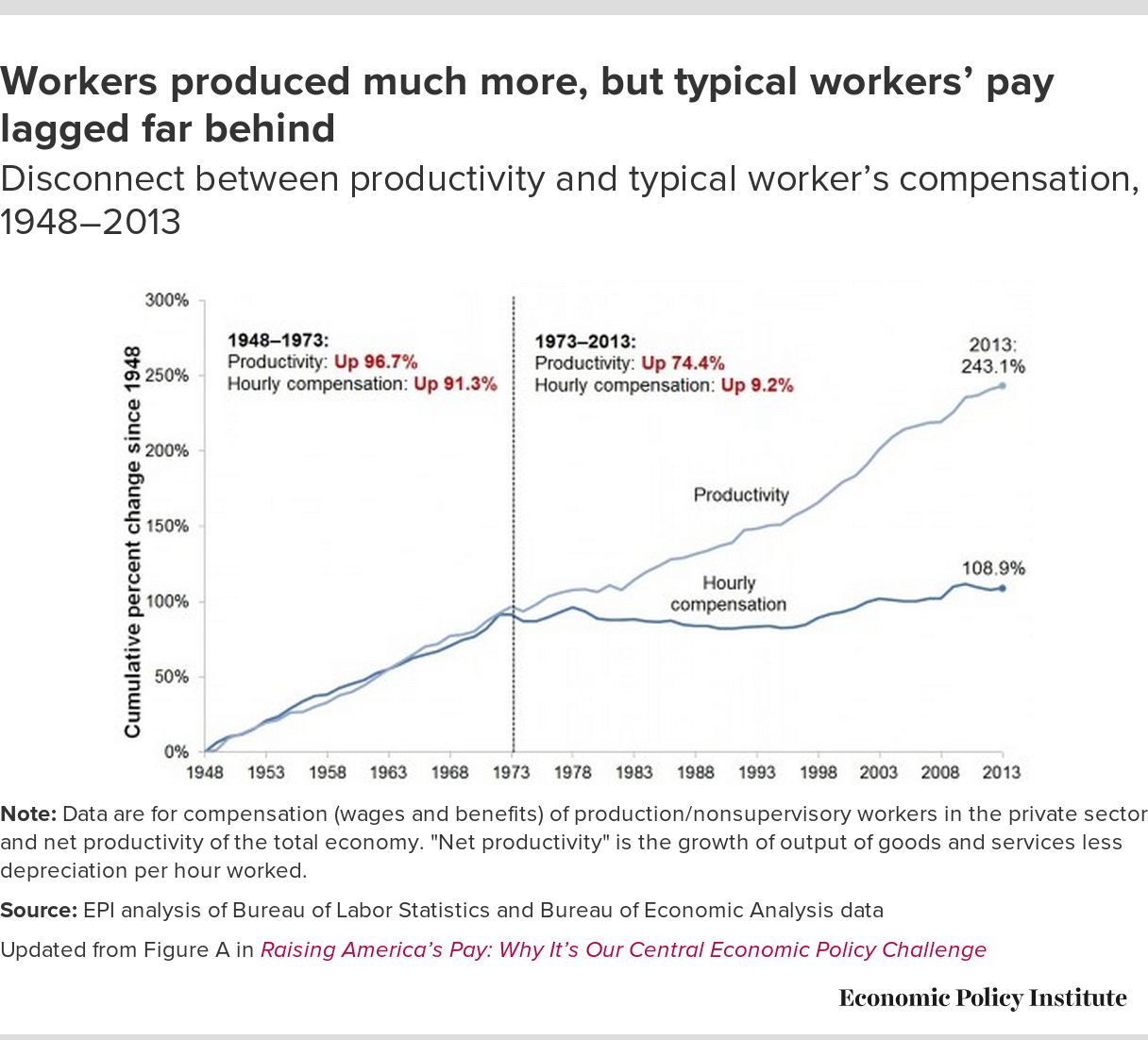

The Evidence Stacks Up: Card and Krueger’s 1994 study found moderate wage hikes don’t tank jobs; they lift productivity and retention. Piketty’s data shows wealth pooling at the top—productivity’s up 60% since 1979, but wages barely crept 10%.

The Gap’s Real: A CEO rakes in $16 million yearly; a worker, $39,643. That’s not meritocracy—it’s math gone rogue.

Why It Matters:

These aren’t just stats—they’re lives. Underpay workers, and you choke their ability to contribute. Society doesn’t just tilt; it weakens.

A Way Out

The old scare—“higher wages kill jobs”—is a myth. Pay people enough to live, and they spend more, propping up local economies. Costco thrives paying above average; Gravity Payments saw profits soar after a $70k minimum wage. Compare that to CEOs pocketing millions while workers scrape by.

How to Move:

Federal Fix: State-level patches won’t cut it. A national wage, phased and regionally tuned, resets the floor.

Business Shift: Audit pay against MIT or EPI benchmarks. Bank of America’s $25/hour pledge shows it’s doable—others can lead too.

Bigger Thinking: Marx saw labor’s value exploited; stakeholder capitalism flips it—firms win by lifting workers, not just shareholders. The market will sort out the weak; the strong will adapt.

Why It Works:

This isn’t idealism—it’s economics. Fair pay cuts healthcare costs, boosts output, and stabilizes communities. The transition’s messy, but stagnation’s costlier.

Next Steps

Leaders: Audit wages now. Stack them against MIT’s regional data. Act on the gaps.

Policymakers: Use NBER and EPI studies. Craft a wage plan that’s gradual but real.

Workers rights: CEO’s will most likely not change a system that benefits them, political pressure and organizing should be pursued if workers are to earn their rights.

The Question of our times: If your success depends on people, what’s stopping you from paying them like it?

The data’s stark, the stakes are high, and the fix is within reach. An economy isn’t just profit margins—it’s people. Let’s build one that values both.

References

Card, D., & Krueger, A. B. (1994). Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania. American Economic Review, 84(4), 772–793.

Economic Policy Institute. (2020). Raising the Federal Minimum Wage: A Prescription for Reducing Poverty and Inequality. Retrieved from epi.org.

MIT Living Wage Calculator. (2025). Los Angeles: livingwage.mit.edu/counties/06037; Kansas City: livingwage.mit.edu/metros/28140.

Piketty, T. (2014). Capital in the Twenty-First Century. Harvard University Press.

The Economist. (2009–2025). Big Mac Index. Retrieved from economist.com/big-mac-index.

Department of Numbers. (2009). Historical Rent Data. Retrieved from deptofnumbers.com/rent/us/.

Macrotrends. (2025). NASDAQ Composite Historical Chart. Retrieved from macrotrends.net/1320/nasdaq-historical-chart.