- The Level Up

- Posts

- The end of the Trump bump and More Wisdom from the Oracle of Omaha

The end of the Trump bump and More Wisdom from the Oracle of Omaha

Market Update

Quick Hits for Skimmers:

Tariffpalooza: China 10% now, Mexico/Canada 25% soon, global D-Day April 2.

Tech Meltdown: $1.5T vaporized—Tesla’s skid could’ve bought Iceland.

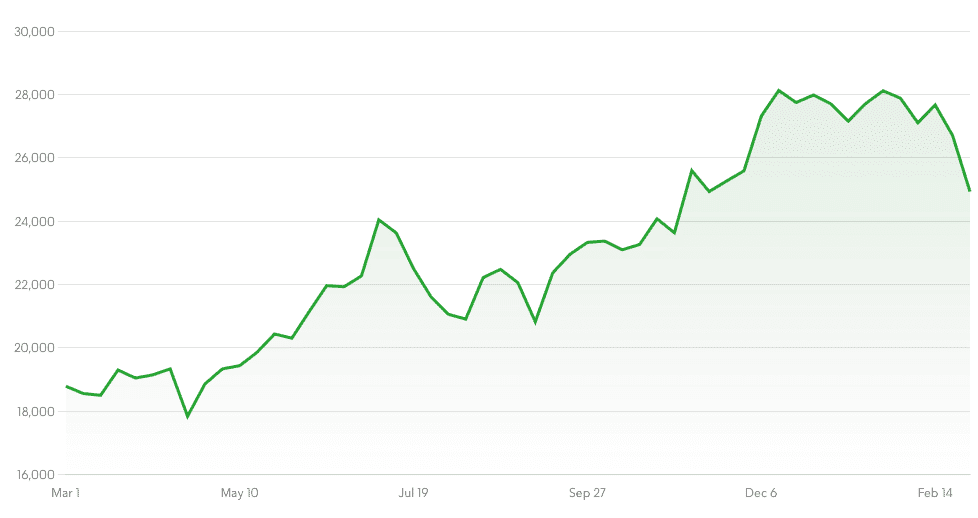

The Trump Bump’s Epic Faceplant

Picture this: You’re sipping champagne at the Trump Bump bash—deregulation dreams, tax-cut buzz, the S&P 500 spiking like it’s on a Red Bull drip. Everyone’s high-fiving, your portfolio’s flexing, and then—crash—the DJ scratches the record. That party’s toast, folks, and your investments are stumbling out with a pounding headache. The S&P’s coughed up its 2025 gains, the Magnificent 7’s down 10% like a tech boy band past its prime, and Tesla? Oh, Tesla’s leading the nosedive—30% in February—like a Cybertruck doing 60 into a brick wall. Welcome to the Trump Slump, where tariffs, tantrums, and a whole lotta “what the hell” are spiking the punch. Grab a seat—this one’s a doozy.

The Rally’s Wreckage

Once upon a November, Trump strutted back into the White House, and Wall Street threw a parade. The S&P 500 hit a record high last Wednesday, Big Tech was popping corks, and the vibe was “to the moon, baby!” But fairy tales end, and this one’s got a Grim Reaper twist.

The S&P’s back to flatline for the year, the Mag 7’s dropped $1.5 trillion—poof, gone, like a magician’s worst trick—and Tesla’s February flop is its second-ugliest ever, only topped by the 2022 tech massacre.

Bloomberg Magnificent 7 Total Return Index

Source: Bloomberg

What’s the buzzkill? A cocktail of chaos, shaken not stirred. Consumer confidence took a swan dive in February—sharpest drop since mid-2021—because apparently egg prices, tariff threats, and “is this guy serious?” vibes are the new fear trifecta.

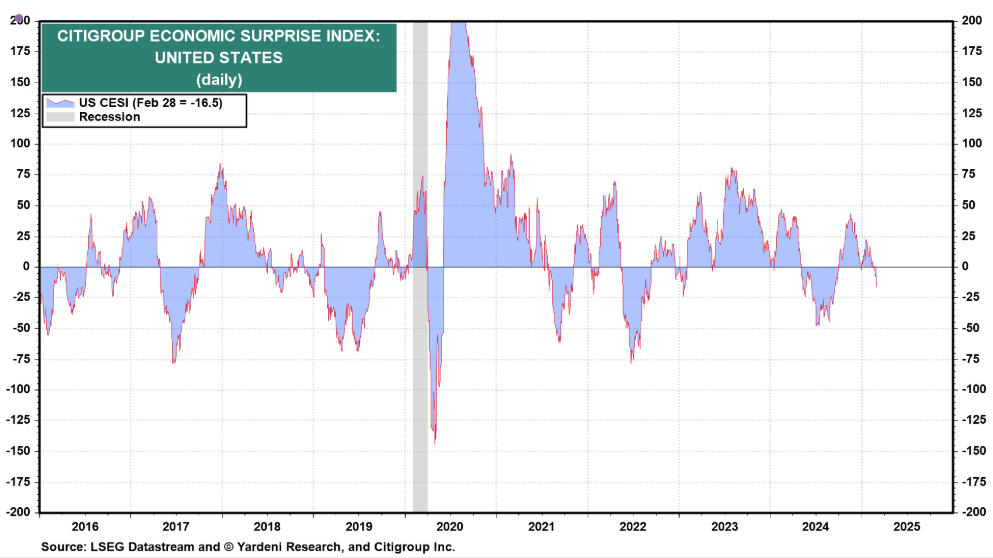

Retail sales flopped like a bad sitcom, oil’s moping at a two-month low, and the Citigroup Economic Surprise Index is blinking red like a “Game Over” screen. (Surprise? Only if you thought tariffs were just locker-room talk.)

Your 401(k)’s doing the cha-cha with a chainsaw. Time to peek under the hood and see what’s smoking.

Tariff Tantrums and Tech Tremors

Enter Trump’s favorite plaything: tariffs. He’s been dangling trade wars like a reality TV teaser—Will he? Won’t he? Tune in next week!—but this week, he stopped flirting and swung the wrecking ball. China’s already ponying up 10%, Mexico and Canada are bracing for a 25% gut punch, and Beijing gets an extra 10% because why not? Then comes April 2, when “reciprocal” tariffs hit everyone—imagine a toddler smashing a Lego castle, except the bricks are global supply chains, and we’re the ones picking up the pieces. (Got a tariff scorecard? Me neither—pass the aspirin.)

Europe’s in the crosshairs too—Trump’s eyeballing 25% on cars and “all other things” because the EU’s $300 billion trade deficit is apparently a personal insult. European stocks got the memo: Volkswagen’s down 1.8%, Stellantis tanked 5.2%, and the Stoxx 600’s looking like it needs a hug. Back stateside, Nvidia tried to play hero with Q4 earnings—revenue beat the street—but margins slipped to 71%, a whisper shy of Wall Street’s wet dreams. In this jittery market, even a golden goose can trip over its own feathers.

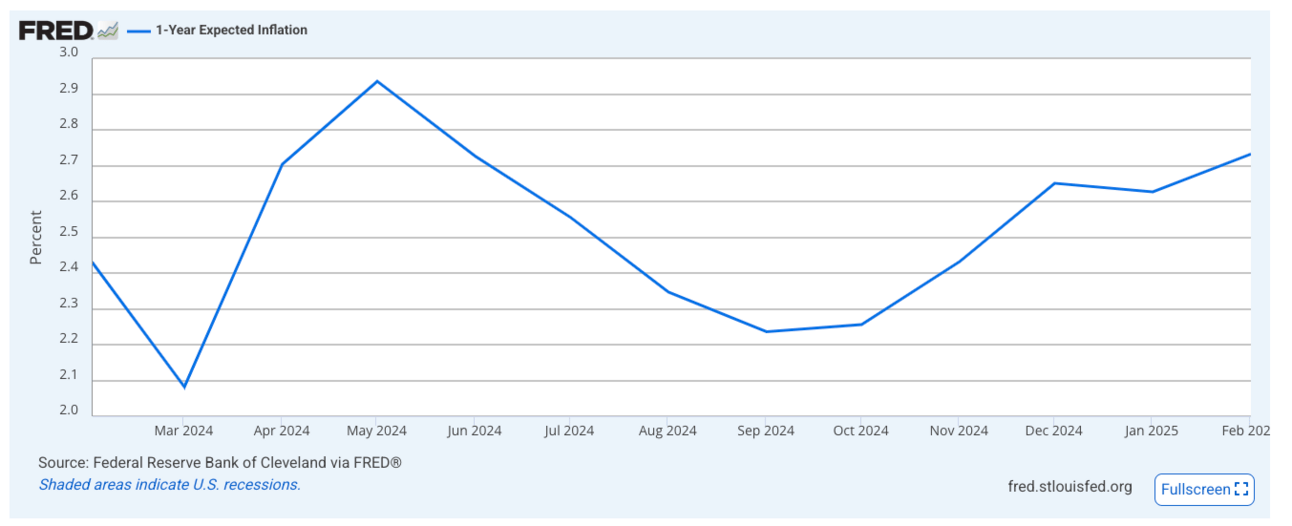

1 Year inflation expectations creeping up (source:Fed)

So What? Trade wars aren’t just noise—they’re a sledgehammer to GDP, and your tech stocks are the nails.

Steady Hands Win

So, where’s the scoreboard? The S&P’s at zero for 2025, the dollar’s puffing its chest like a safe-haven gym bro, and Treasury yields are flirting with 4.25%—a recession dog whistle if you squint. Inflation’s creeping toward 6%, consumer gloom’s hit “yep, we’re screwed” levels (Expectations Index: 72.9), and sentiment’s so sour you could pickle it.

Citi’s economic Surprise index hit a low last seen in Sept. (source: yardeni research)

But hold the panic button—we’ve tangoed with storms since Covid and kept the lights on. Britain’s already charming its way off Trump’s tarriff list, and his big threats have a habit of fizzling like a damp firecracker. Still, this one’s got a Category 5 vibe—data’s ugly, vibes are uglier. If you’re checking your Brokerage app this weekend, pair it with bourbon, not a “sell all” spree.

So What? This slump’s a bar fight, not a funeral. Keep your cool—winners don’t flinch.

Tariff Cheat Sheet:

Now: China 10%—ouch.

March 4: Mexico/Canada 25%, China +10%—double ouch.

April 2: Global trade gets the full Trump handshake.

Trump, probably: “The EU’s been screwing us since Napoleon. Sad!”

Next Steps: Your Playbook

Tool Up: Bloomberg’s Mag 7 Index is your slump-o-meter—stare at it till your eyes cross.

Challenge: Dig into Tesla’s 10-K for its Mexico exposure—spoiler, it’s a spicy enchilada of risk.

Reflect: Are you a “markets always bounce” optimist or a “sky’s falling” doom scroller? Scribble it down—clarity’s your VIP pass through the chaos.

The Trump Slump’s in town, folks—a messy, loud, uninvited guest. It’s not the apocalypse (yet), but it’s not a drill either. Keep your wits sharp, your portfolio nimble, and maybe your sense of humor intact—spring’s shaping up to be a blockbuster.

Bites of Wisdom from Warren Buffett

Ever wish you could pick the brain of the world’s greatest investor over a plate of nachos? Well, Warren Buffett just served up his annual shareholder letter, and it’s a feast of wit, wisdom, and a few sharp jabs at Washington. At 94, the Oracle of Omaha’s dishing out lessons on succession, cash piles, and why he’s sneaking a few Japanese bites on the side. Hungry? Let’s dive into this six-course smorgasbord of investing gold.

The Master Chef Speaks

Buffett’s annual letter isn’t just for Berkshire Hathaway insiders—it’s a free masterclass for anyone with a buck and a brain. This year, he’s cooking up insights on who’ll take his throne, why he’s not gorging on stocks, and how Berkshire’s stuffing Uncle Sam’s wallet. Plus, he’s got a spicy warning for the Trump administration that’ll make you sit up straight. No fluff, just the good stuff—let’s eat.

Six Tasty Nuggets of Buffett Brilliance

Buffett doesn’t mess around. Here’s the meat of his message, seasoned with a little sass:

Succession: Passing the Apron

At 94, Buffett knows he’s not flipping burgers forever. Enter Greg Abel, his hand-picked successor, ready to keep the Berkshire grill sizzling. The secret sauce? A creed of honesty and transparency. Buffett’s warning: ”start fooling your shareholders, you will soon believe your own baloney and be fooling yourself as well”Takeaway: Trust matters—pick leaders who don’t cook the books.

No Stock Buffet Right Now

Why isn’t Buffett piling his plate with stocks? Simple: “really outstanding businesses are very seldom offered in their entirety, but small fractions of these gems can be purchased Monday through Friday on Wall Street and, very occasionally, they sell at bargain prices” and even the juicy bits rarely hit the discount bin. Some days, the market’s a treasure trove; most days, it’s a yawn. He’s not starving—he’s just picky.Takeaway: Don’t scarf down every deal. Wait for the Michelin-star stuff.

Cash: The Secret Ingredient

Berkshire’s cash stash has pundits whispering “chicken!”—but Buffett’s unfazed. “The great majority of your money remains in equities,” he says, and that’s not shifting. Last year, marketable stocks dropped from $354 billion to $272 billion, but controlled equities ticked up. Cash isn’t fear—it’s fuel for the next big bite.Takeaway: Keep some dough in reserve—great meals take time.

Japan: A Side Dish Worth Savoring

Buffett’s an American meat-and-potatoes guy, but he’s got a taste for Japanese fare. For six years, he’s been nibbling on five companies—ITOCHU, Marubeni, Mitsubishi, Mitsui, and Sumitomo—that echo Berkshire’s style. He’s capped at 10% ownership but just got the green light to pile on more. Decades, not days, is his timeline.Takeaway: Don’t ignore the global menu—good flavor knows no borders.

Tax Bill: Feeding Uncle Sam’s Appetite

Berkshire didn’t just fill its own belly—it stuffed the IRS’s coffers with a record-breaking $26.8 billion in 2024. That’s 5% of all corporate taxes in the U.S., outpacing even trillion-dollar tech titans. Buffett’s not griping—he’s grinning, proud to pay up.Takeaway: Cough up your share, but pray it’s not wasted on junk food.

A Spicy Warning for Washington

Buffett’s got a stern word for the Trump team: don’t burn the dollar. “Paper money can see its value evaporate if fiscal folly prevails,” he cautions, nodding to history’s close calls. His recipe? Spend smart, help the unlucky, and keep the currency steady—or we’re all toast.Takeaway: Fiscal foolishness spoils the pot—stability’s non-negotiable.

And a final word of wisdom from Buffett:

“Take care of the many who, for no fault of their own, get the short straws in life. They deserve better.”

This letter’s a Michelin-star crash course in investing—and life. Digest it slow; it’s too good to rush. After all those metaphors I’m going to make myself some dinner!

Next Steps: Your Taste Test

Dig In: Grab Buffett’s full letter here—it’s free and beats most $30 finance books.

Challenge Yourself: Look at one stock you own. Would Buffett touch it? If not, why are you?

Reflect: Too much cash or too much impulse buying? Rate your “Buffett vibe” on a scale of 1-10.